Hello, my friends. This is going to be the last week of January with the FOMC meeting on Wednesday, the British Central Bank meeting on Thursday, and the NFP on Friday. We are not in the trending profile. I have my opinions and potential scenarios, but I don´t dare to predict the exact price action for the week before the market opens.

Instead, I will be flexible with my mind open and wait for the setup to present itself. I will look at intraday setups on my pairs in sessions without big news. Which means trading on Mo / Tu / We / Th – London sessions.

This week is fully loaded with the Red news and Central bank announcements. Monday doesn’t have any items. Every other day is loaded with red news and the main item will be FOMC and NFP.

FED will most likely not change interest rates but the comments will be important. Same for Pound, inflation has grown a bit so I do not expect BOC to reduce interest rates as it was expected.

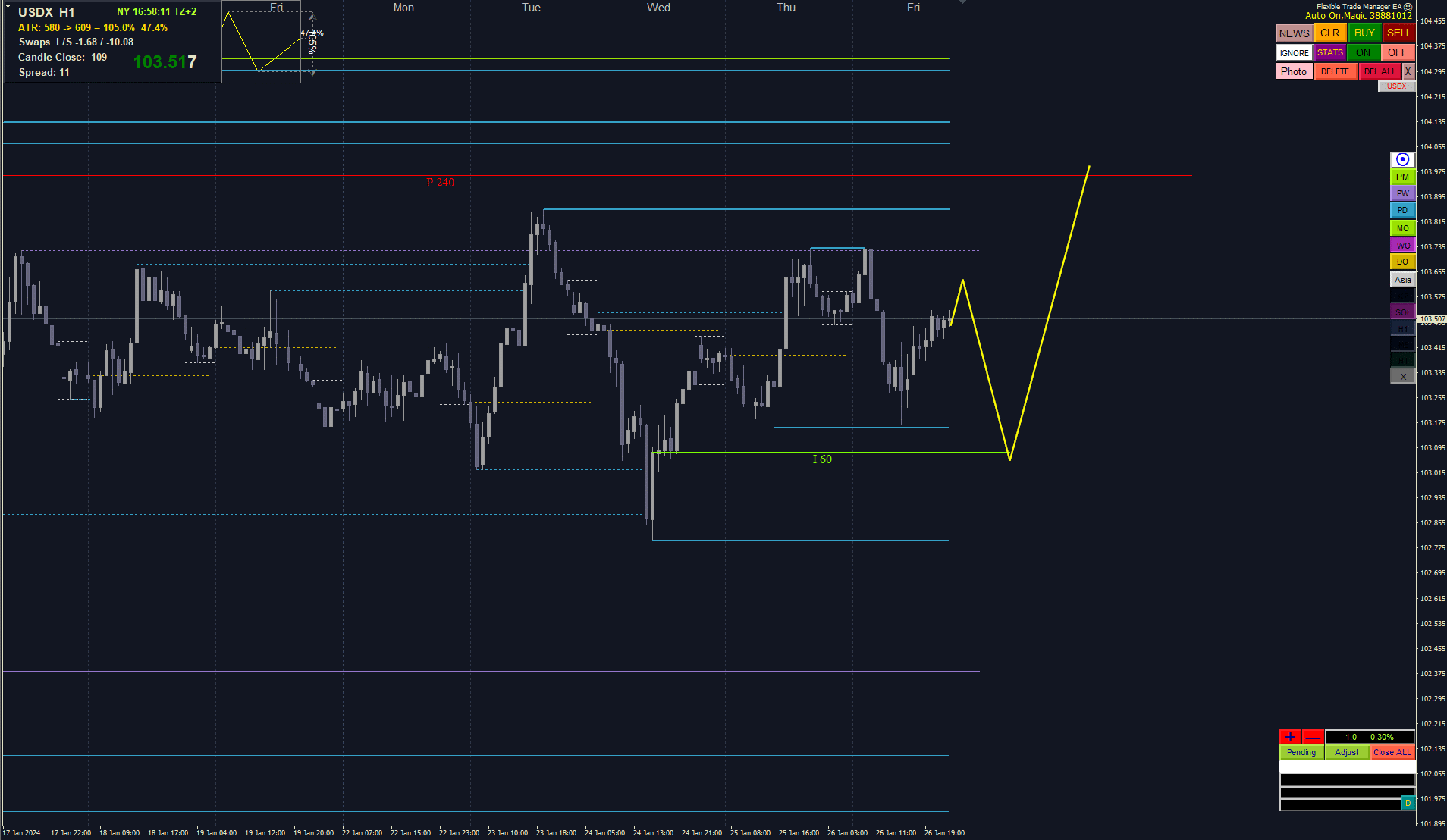

Dollar Index

The dollar has topped in the last year October. Since then the DXY is in the slide down. In my opinion, the price will visit the 100 territories in the future. Market makers have left nice equal lows – liquidity zone. However, I think we still could go a bit higher first.

We can see that large speculators are betting on the weak USD too in an overall decrease of the Net positions in the COT data. For our analysis, I´m focusing on the last 6 weeks where we saw a swing up. We can see that shorts have been growing and I think the dollar will see a pullback down soon, however for this week I think there is still a possibility for push-ups.

If you checked the positions you should see that they were adding shorts positions, reducing longs and overall net exposure is dropping. That is a clue that they are bearish and they are preparing to take the price lower. We need to see signs in the price action on LTF (Lower Time Frame).

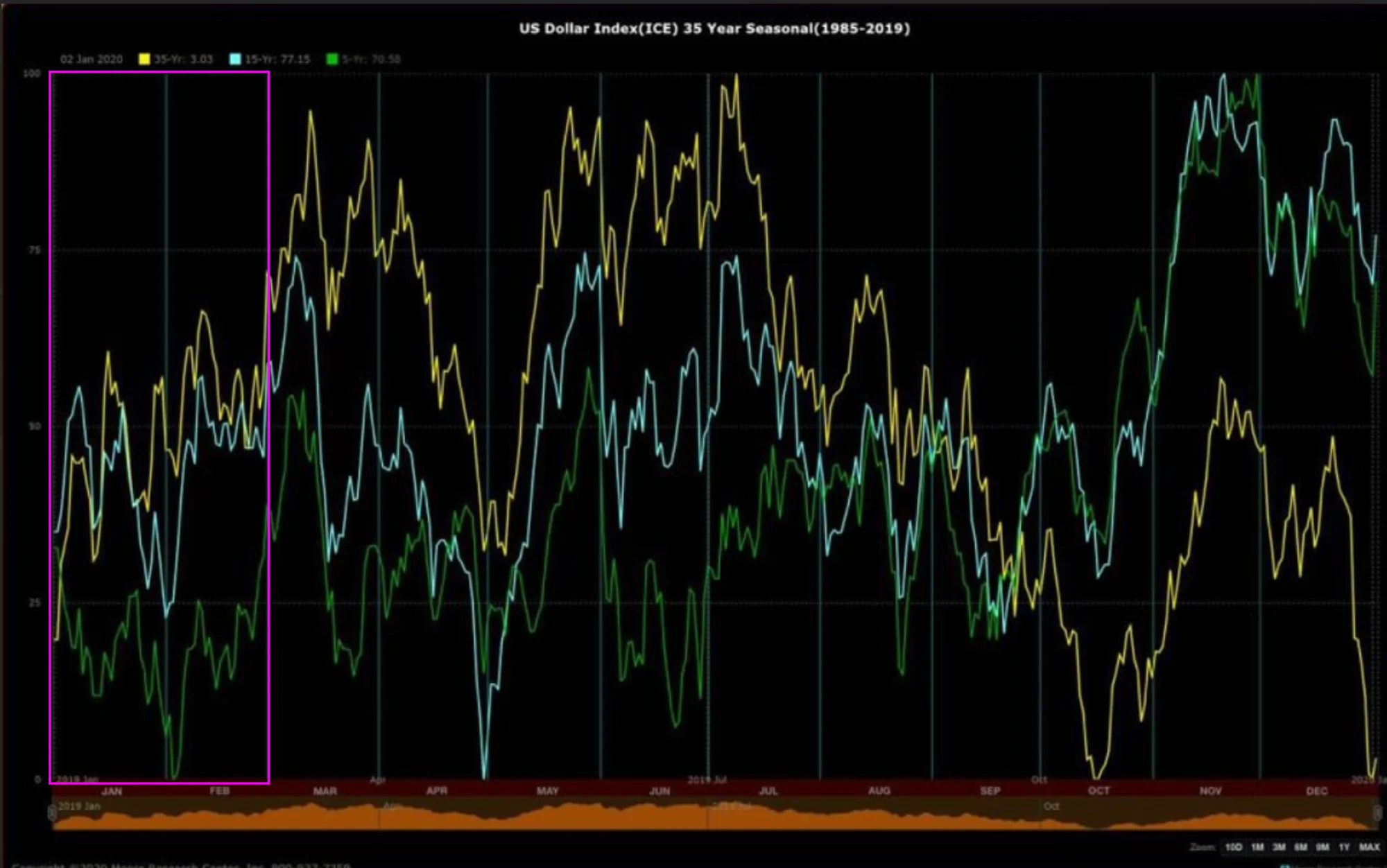

DXY Seasonal tendencies

EURUSD

Price has been dropping for the past 5 weeks since it topped in December. Price is just right above the OB where I think we will see a drop and possible short-term bounce up. We are not in the trending environment so I will not be looking for any long-term positions.

I will be focusing on intraday setups. For now, I like the following levels

EUR Seasonal Tendencies

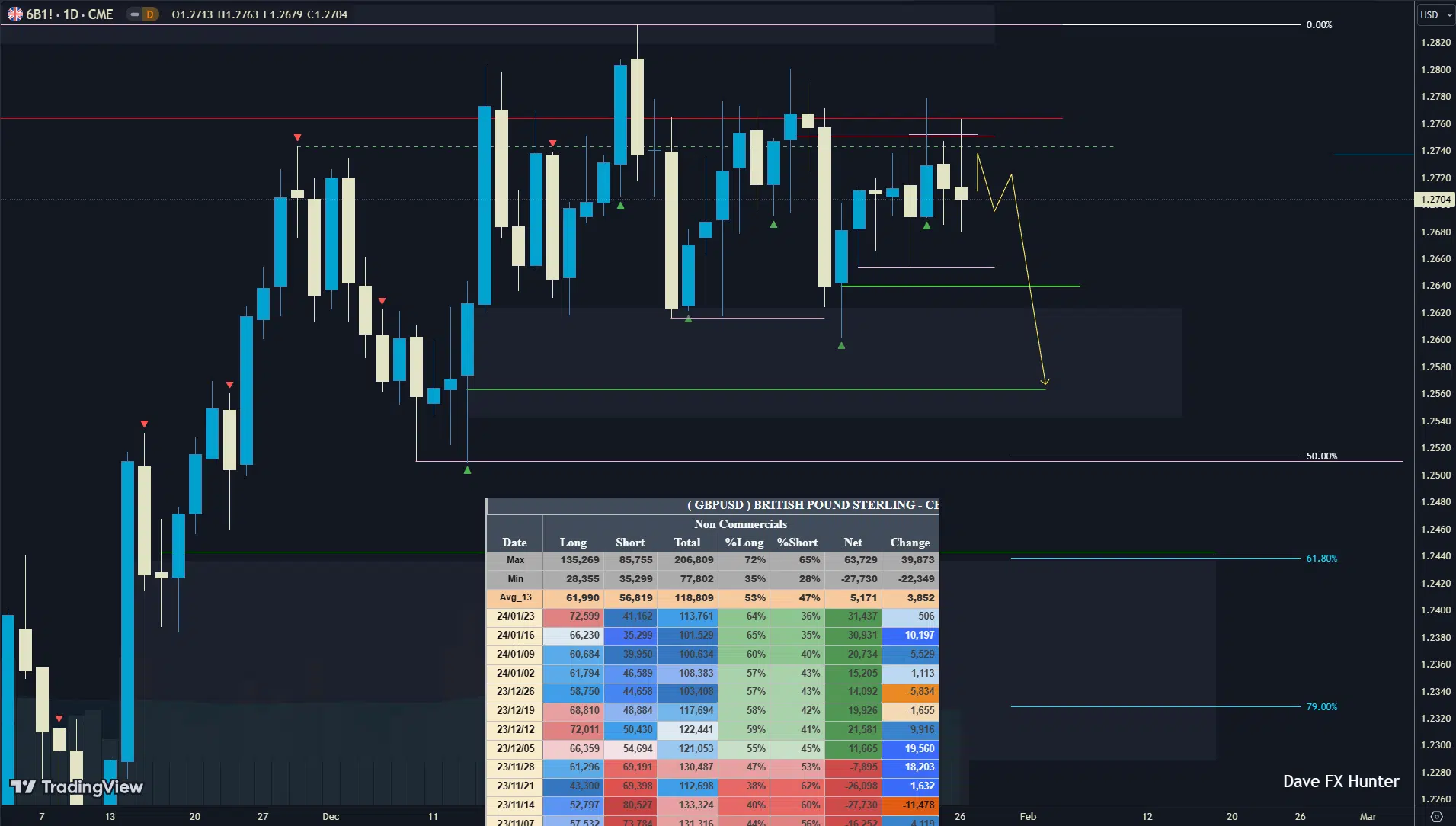

GBPUSD

The pound has been in the range for quite some time. This week BOE meeting and they probably not change the interest rates. COT is ultra-bullish however I would not be buying at the current level. I like OB approximately 70 pips lower

As mentioned this is not a trading environment so only short-term positions for me currently

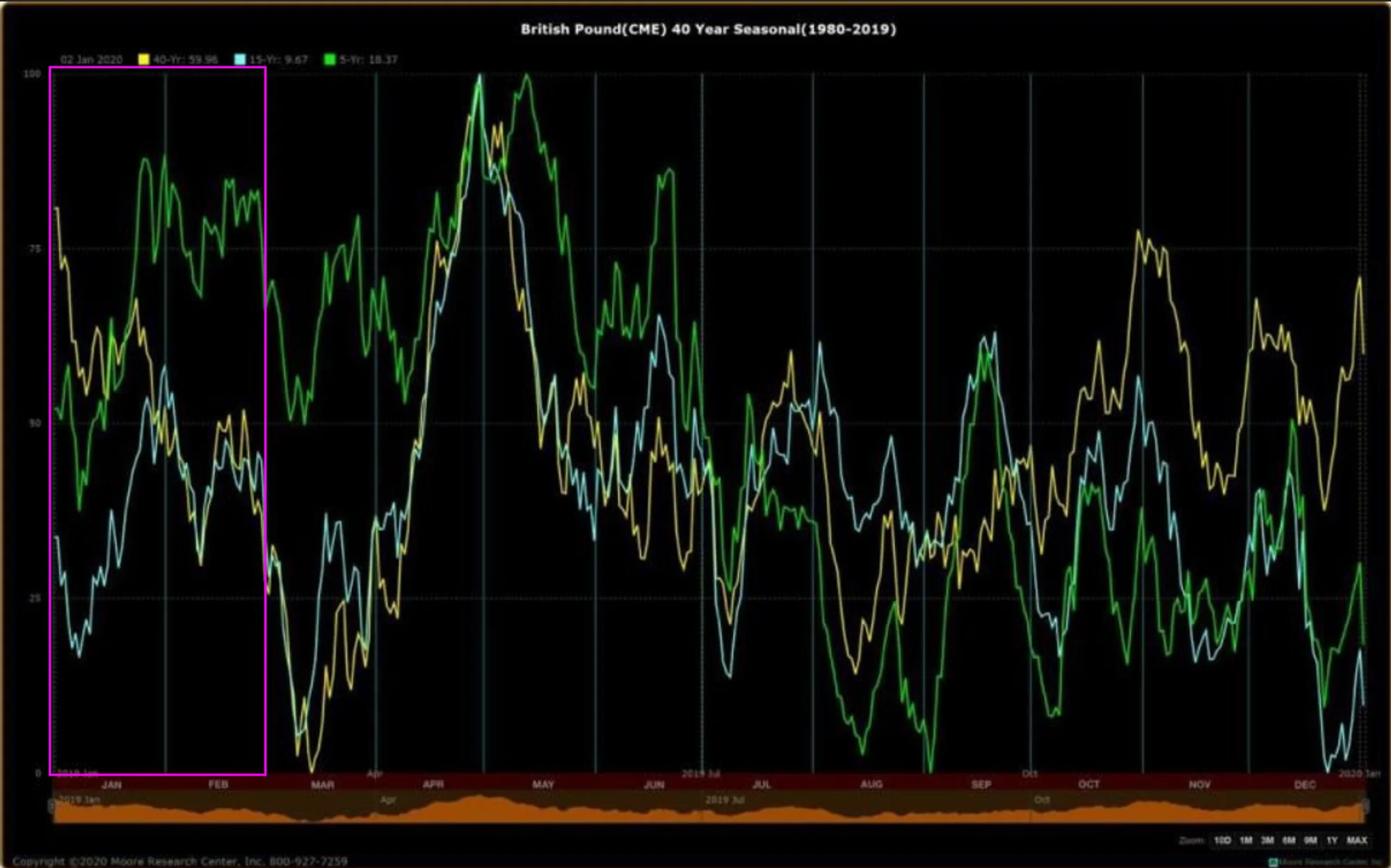

GBP Seasonal Tendencies

USDCAD

USDCAD price topped in November when it created a yearly high right into the rejection block. Since then we can see the price moving down. The last 4 weeks’ push-up is just below the important level. In my opinion this week still can be bullish as the price still hasn’t reached 61.8 Fib yet.

I think something like this could be forming. Would be interested in shorts around 1.35 and longs below the previous week’s lows.

CAD Seasonal Tendencies

The Canadian Dollar has mostly been strong at end of the January / beginning of February. Which means USDCAD is down. It can be that dip before the price goes up again.