Did you know a weekly report shows the trading moves of top futures market players? This report, the Commitment of Traders (COT), is key for those who analyze futures markets. It might look complex at first, but we’ll break it down to show its value.

The COT report is more than just numbers. It’s a guide for traders who want to make smart choices. We’ll look at how different traders’ actions show market feelings. This guide will help you understand and use this data for your trading.

Key Takeaways

- Weekly COT reports are a goldmine of actionable data for futures market analysis.

- Understanding the positions of different trader categories can disclose key market sentiments.

- Commercial entities and large speculators play significant roles in shaping market trends.

- Our guide provides an in-depth exploration of the COT insights for informed trading.

- Following this guide could enhance traders’ strategies through comprehensive COT report interpretation.

Understanding the Commitment of Traders (COT) Report

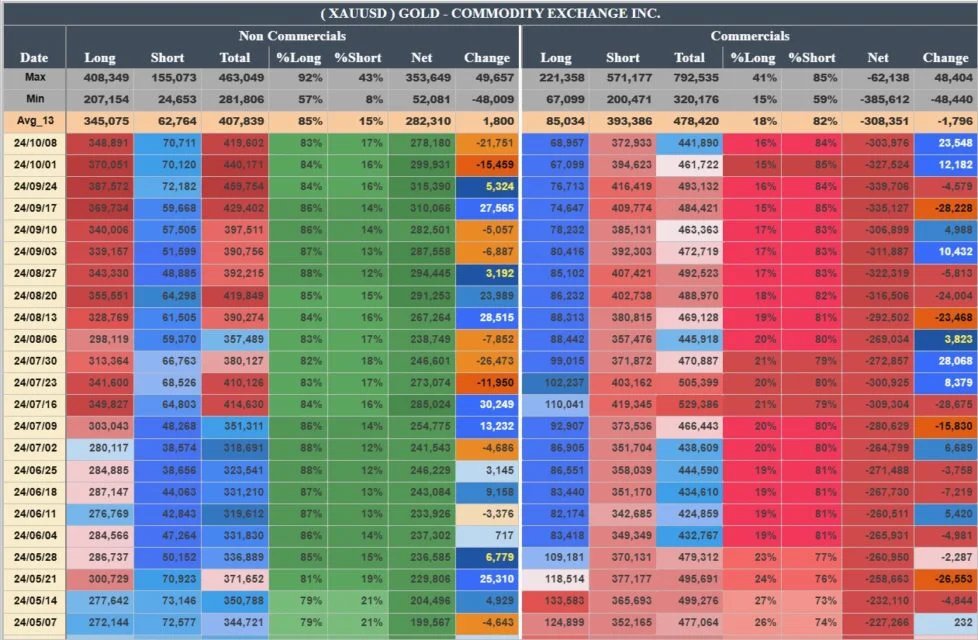

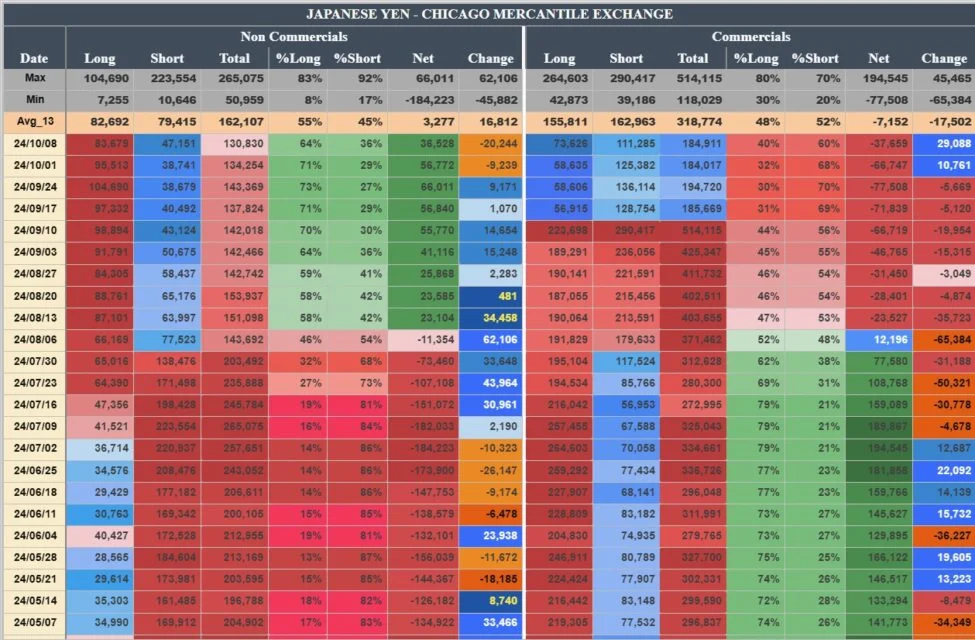

The Commitment of Traders (COT) report is a weekly release from the Commodity Futures Trading Commission (CFTC). It’s designed to help you understand how to read COT effectively. This report gives a detailed CFTC data analysis, showing the positions of different market participants in commodities.

The COT report’s details can give deep insights into futures trading strategies. By knowing the positions of commercial traders, large speculators, and small traders, you can better understand market dynamics. Each type of trader has a unique role, affecting the market in different ways. Learning to analyze these details can improve your trading decisions, making them more informed. Note: the report their positions on Tuesday and CFTC reports them on Friday, so you must read between the lines to understand it. Also, you might realise that markets often creates low or high of the week on Tuesday. Why ? I believe there is a connection between COT report. They know that we are watching this data and they must report so they report what they want you to see and try to hide the cards as long as possible.

We’ll dive into the COT report’s sections, breaking them down. This helps us see the positions of key market participants more clearly. It’s crucial for both experienced and new traders to grasp these details. They help predict market movements and adjust strategies.

Keep following as we delve deeper into the COT report. By the end, you’ll not only know how to read COT but also how to use this knowledge for trading success.

The Commitment of Traders and Market Sentiment

In our look at market sentiment analysis, understanding COT data is key. This data shows us the positions of different trader types. It acts as a strong sentiment indicator. By looking at this, we can see if people think a commodity will go up or down.

Using COT data helps us spot trends better. When traders have extreme positions, it can mean the market is overbought or oversold. Knowing this helps us predict when the market might change, giving us an advantage. This knowledge helps us make smart moves in fast-changing markets and find good chances to make money.

Using tools that offer expert analysis can really help us understand these complex data sets. A great tool is professional forex signals. They add to our analysis with expert views.

To make the most of market sentiment analysis, we need to mix our COT data knowledge with what’s happening now in the market. This detailed look helps us find trends accurately. It lets us make smarter, more informed trades in the futures markets.

Breaking Down the Categories of Traders

In the world of futures trading, knowing about trading entities classification is key. The Commitment of Traders (COT) report shows three main groups: commercial traders, large speculators, and small traders. Each group has its own reasons and ways of trading, affecting the market.

Commercial traders are like hedgers. They use futures to manage risks in their businesses. They might be in agriculture, energy, or manufacturing. Futures contracts help them deal with price changes in important goods or currencies.

Large speculators are different. They include hedge funds and trading firms that aim to make money from short-term trends. They watch global news and use big money and smart strategies to make the most of market changes. Their moves can tell us a lot about where the market might go next.

Small traders, or retail traders, are the individual investors. They don’t have as much money as big traders but still show what the market feels like. Their actions can tell us about how the market might react to big changes.

To understand how these groups affect trading and market predictions, we need to look at detailed reports and analyses. The COT report is a big help here. It tells us about the strategies of different traders. For more tips on trading, especially in tough times, FX Hunter Wealth offers useful advice. They focus on managing risks and improving day and swing trading.

Interpreting COT Data for Trading Insights

Interpreting the COT (Commitment of Traders) report is key to better trading decisions. The report shows weekly changes in trader positions. This lets us see future market moves more clearly.

For beginners, COT report interpretation means looking at different trader groups’ positions. It’s not just about the numbers. It’s about how these positions affect the market. Knowing how to link these changes with past price actions helps us plan better.

Understanding the scale and scope of these traders can give us big trading insights. It helps us guess market trends before others see them.

Using this knowledge in our market analysis helps us make smart trading choices. It’s great for both short-term trades and long-term investments. COT data is especially useful for deciding when to enter or exit trades. For more on this, check out this link.

In summary, understanding the COT report gives us deeper trading insights. It helps us make decisions before the market does. By knowing what traders are doing, we can spot opportunities others might miss.

Commitment of Traders Ultimate Guide: Making Data Actionable

We aim to turn raw Commitment of Traders (COT) data into actionable trading strategies. It’s key to understand how to make this detailed info into steps we can take. We look for COT swing signals and study the momentum to find important market insights. Our goal is to find the best times to enter and exit the market, giving us an edge in market analysis.

By using weekly COT reports to create actionable trading strategies, we improve our timing in the market. Knowing the commitment of traders is more than just looking at data. It’s about using this info with hedging techniques that match current and future market trends.

Expanding our knowledge, we provide forex signals based on these data. This helps traders manage risks well and increase their profits. These strategies make sure our hedging techniques are based on solid analysis and forward thinking.

To do well, using COT swing signals means spotting important patterns in trader commitments. This skill helps us make quick decisions and plan for the long term. It lets us adapt to changing market analysis situations.

In short, making COT data useful requires a deep understanding of the market. We need tools and strategies that use this info well. Through careful market analysis and smart use of hedging techniques, our trading choices get better. This boosts our chances of success.

Commercial Traders’ Impact on Futures Pricing

It’s key to know how commercial hedgers affect futures contract pricing. These traders use futures markets to manage risks. They aim to keep costs and revenues steady, even when markets are unpredictable. This helps make the market more liquid, leading to better price discovery and less risk.

Watching what commercial hedgers do can tell us a lot about market trends. For example, more hedging might mean a market drop or rise, based on global economic signs. So, understanding their moves is as important as looking at market data.

Commercial hedgers do more than just make money. They help keep the market stable and liquid, making it better for everyone. By studying their trading, we can better understand futures contract pricing. For more advanced trading, check out platforms with sophisticated risk management tools.

Our study shows how crucial commercial hedgers are to financial markets. They boost market liquidity and act as a buffer against wild price swings. This creates a fair trading space for all.

Spotting Market Extremes with COT Data

When we do COT analysis, we aim to find market extremes. These extremes show when the market might change direction. By spotting these signs, we can get ready for big changes in the market.

Market extremes happen when everyone thinks the same way, too much on one side. These moments are key because they often lead to big price changes. It’s important to understand why these extremes happen. With COT analysis, we can figure out if these moments will just be a quick fix or start a new trend.

Traders need to be careful when looking at COT reports. For example, if big speculators are very bullish and buying a lot, it might mean prices are about to drop. This could mean we should be careful or even go bearish.

Also, by learning about market patterns and disciplined trading, we can make better plans. We use this knowledge to make smart moves based on these market extremes.

The main thing is to use this knowledge wisely. It helps us prepare for potential reversals after these big market moves. This way, we can avoid surprises and make more money in our trades.

Large Speculators and Short-Term Price Drivers

Looking into futures markets, we must see how large speculators affect price momentum and short-term market trends. These big players, like hedge funds and managed money, are key in speculative trading. By checking the Commitment of Traders (COT) reports, we learn how they sway market ups and downs.

Knowing what large speculators do helps us predict market price moves. When they buy more, it usually means good times ahead and prices might go up. But if they sell more, it could mean prices might fall, showing a bearish mood. This is especially true in markets where speculative trading is big.

For traders who want to keep up, knowing price momentum is key. This info helps them plan their portfolios for quick price changes. For a deeper look, tools like The Mars EA can show how speculators compare to market liquidity.

Watching large speculators gives us a clear view of their power to change prices and shape price momentum.

In summary, large speculators play a big part in futures markets. By following their moves in COT reports, traders can be ready for quick short-term market trends. This helps them make better trades and avoid risks in high-stakes markets.

The Role of Small Traders in the COT Report

When we look at the COT report role, it’s key to see how small trader behavior shapes the market. Even though small traders, or retail traders, can’t move the market like big institutions, their actions together give us important clues. These clues help us understand market trend analysis.

Our study shows that these retail traders can act as a warning sign. This happens when many small traders bet against the current market trend. By looking at their combined positions, we can feel the mood of retail investors. They often react differently when the market is at its peak or trough.

Grasping this part of the COT report gives us a deeper look at market feelings. It helps us see how trends can change based on how retail traders react. This shows us bigger economic signs and the flow of speculation.

Weekly CFTC Reports and COT Analysis

We are dedicated to giving you the best trading insights. We focus on cot report analysis and the importance of weekly CFTC data. These reports from the Commodity Futures Trading Commission are key for traders to understand market trends and make smart choices.

It’s important to understand these reports well. Every week, new data comes out. This lets traders see how market sentiment is changing and adjust their plans.

Using cot report analysis in our market checks is more than just keeping up. It’s about being ready to move with the market. By looking at these reports often, we can predict and act fast. This is key for staying ahead in trading.

For the best use of these insights, check out forex risk management strategies. It offers tips on using these insights to reduce risks and grab market chances.

We think combining weekly CFTC data and deep market trend assessment through cot report analysis gives traders the edge they need. It’s not just about having info. It’s about turning it into useful, strategic trading moves.

We aim to make complex data into valuable trading chances. This way, our readers are always ahead in the financial markets.

How COT Data Enhances Swing Trading Strategies

Swing traders aim to make profits from market changes in a few days to weeks. We rely on Commitments of Traders (COT) data to back our trading strategies. This data helps us see market sentiment shifts that hint at trend reversals.

By using COT data, we look into the actions of different traders. Knowing their positions helps us predict big market changes. This is key in swing trading. COT reports show when markets might flip, signalling a trend reversal.

Combining COT data with technical analysis tools sharpens our trading. This mix helps us pick better entry and exit points. It makes our swing trading stronger, focusing on real shifts in trader behaviour and market trends.

Using COT data well is more than just reading numbers. It’s about applying this data to our trades. This way, we make our trades more precise, cut down on risks, and boost our chances of steady profits.

COT Strategy: Beyond the Basics

To really use the Commitment of Traders (COT) reports, we need to explore advanced strategies. These go beyond simple analysis. They help us gain deep insights and improve our trading strategies.

Advanced COT strategies mix data with other market signs for a strong trading plan. For example, combining COT signals with technical analysis tools like moving averages can give a clear view of market trends. This helps predict when the market might change direction.

This method also looks at long-term trends and patterns in COT data. It offers a deeper look into how markets behave. It’s about linking vast market data with the details in the COT report. This needs a deep understanding of market dynamics but can greatly influence our trading choices.

The aim of these advanced methods is to not just react to market changes but to predict them. It’s a smart way of trading that keeps us ahead in the competitive world of trading. By learning these advanced COT strategies, traders can take part in the market more confidently and gain an edge.

Conclusion

e’ve explored the Commitment of Traders summary in depth. This report is key to understanding market trends and sentiment. It offers deep insights into market behavior by analyzing different trader actions and positions.

Using the COT report well leads to better trading decisions. It gives us detailed information that goes beyond basic market analysis. This knowledge helps us grasp the real forces driving the futures markets.

We encourage our readers to use this information to improve their trading plans. The Commitment of Traders report is a powerful tool for clearer market views. By using COT data, we aim to help our audience succeed in trading. We believe that regularly using COT data will greatly improve our trading skills.

FAQ

What is the Commitment of Traders (COT) report?

The Commitment of Traders report is a weekly release by the Commodity Futures Trading Commission (CFTC). It breaks down open interest in futures markets. It categorizes traders into commercial entities, large speculators, and small traders.

How can traders use the COT report?

Traders use the COT report to understand market sentiment and potential trend reversals. It helps them adjust their strategies for better risk management and timing.

How is the COT report structured?

The COT report has sections for different market participants. It shows long and short positions and changes from the last report. This helps traders grasp market dynamics.

Why is it important to understand the categories of traders in the COT?

Knowing the trader categories in the COT report is key. It shows who’s driving market momentum and how their positions might affect prices. Each group has its own goals, affecting market liquidity and prices.

What are COT swing signals?

COT swing signals hint at market trend turns. They’re based on trader positions in the COT report. Traders look for extreme positions and shifts to spot these signals.

How does the COT report reflect market sentiment?

The COT report shows market sentiment through trader positions. Extreme positions can signal overbought or oversold markets. This highlights sentiment extremes.

Can COT data predict market trends?

COT data doesn’t predict trends but offers insights into current positions and sentiment. It’s a clue to potential market movements when used with other tools.

What role do commercial traders play in the futures market?

Commercial traders, or hedgers, manage risk in their business operations through futures markets. Their activity impacts contract pricing and hints at market conditions.

How can analyzing COT data benefit swing traders?

Swing traders gain from COT data by spotting trends and reversals. It helps them make informed decisions on entry and exit points, improving trade profitability.

What advanced strategies can traders use with COT data?

Advanced strategies include long-term trend analysis and combining COT with other indicators. Sophisticated techniques help understand shifts in market sentiments and position sizes.

How often is the COT report released?

The CFTC releases the COT report weekly, usually on Friday afternoons. It reflects data from the previous Tuesday.

What is the significance of the COT report for informed trading decisions?

The COT report is crucial for informed trading. It offers transparency into futures markets and reveals influential participants’ positions. This is key for understanding sentiment and potential price movements.