Unlock the ICT FOREX TRADING BREAKER’s power and transform how you trade. This unique tool gives you exact signals for when to enter and exit the market. It’s designed for your trading style, making your forex journey exciting and rewarding.

By knowing how the market moves, you’ll spot chances to make money. And with the ICT FOREX TRADING BREAKER, you’ll feel sure and ready as you trade. Let this tool change your trading game and guide you to success.

Key Takeaways

- The ICT FOREX TRADING BREAKER offers precise entry and exit signals for your trading style.

- Understanding market dynamics, such as breakers and liquidity pools, is crucial for unlocking profitable opportunities.

- Blending breakers and liquidity pools can enhance your trading strategies.

- The time of day and day of the week influence market movements, which can be leveraged for trading.

- Accumulation strategies around breakers can help anticipate market moves towards liquidity pools.

Unlocking the Power of ICT BREAKERS

ICT FOREX TRADING BREAKERS understand important market levels. These are not fixed points but ranges. Traders can use these ranges for trading. Learning about these ranges helps traders be more precise and use market patterns to their advantage.

Understanding Breakers

Breakers show where the market’s algorithm reacts. Knowing about breakers gives traders deep insights. They can then make better choices and be more confident in the market.

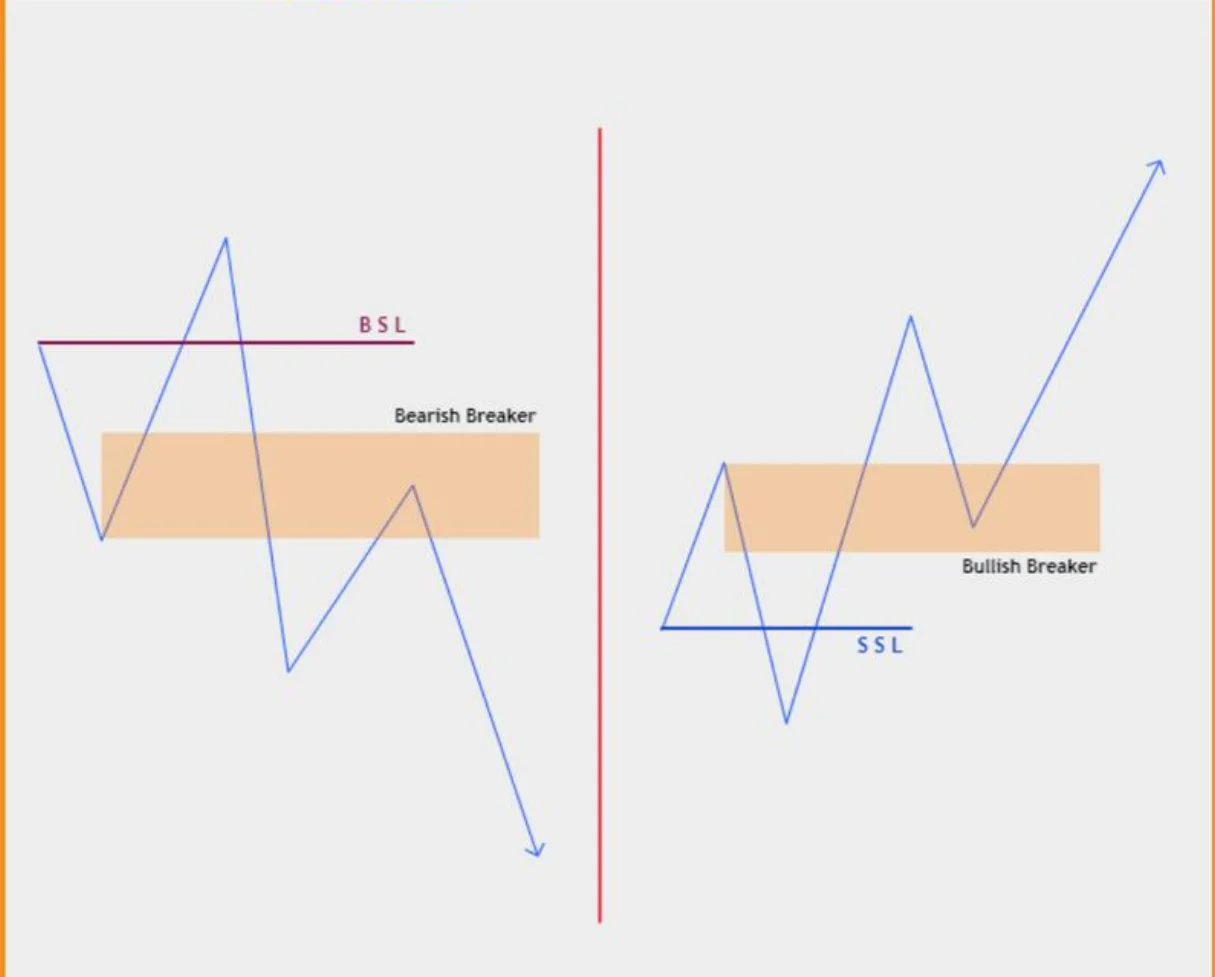

Bearish and Bullish Breakers

There are bearish and bullish breakers. Bearish breakers are for selling, and bullish is for buying. Identifying these breakers lets traders know when to move. They can use this knowledge to their advantage.

Liquidity Pools and Market Movements

Exploring the ICT FOREX TRADING BREAKER, we see liquidity pools are key in market moves. They are spots with lots of buy or sell orders. These pools pull prices towards them. It’s vital to know about these pools for smart trading choices.

Identifying Liquidity Pools

The pricing algorithm constantly updates the market, focusing on these liquidity pools. Discovering how markets react to these pools guides traders. It helps them predict and profit from market changes.

Liquidity Pool Interactions

Understanding liquidity pools gives us market behaviour clues. Watching how the algorithm and pools interact reveals entry and exit points. It’s essential for a successful trading plan with the ICT FOREX TRADING BREAKER.

Blending Breakers and Liquidity Pools

Understanding breakers and liquidity pools is key to using the ICT FOREX TRADING BREAKER successfully. It lets us spot the best times to step in or out of the market, predict market changes, and create a smarter trading plan. To do this, you need to deeply understand how markets work and what affects them.

Combining Multiple ICT Concepts

Breakers mark special price levels where market actions change, and algorithms react.Liquidity pools, on the other hand, are spots with many buy or sell orders that sway the market.1 Knowing about both helps traders forecast and use market changes to their favour. You can even watch for when prices move a lot to figure out new breakers, which give you zones for action. Also, when these events happen, like what day of the week it is, influences how markets move towards these points. A wise strategy is slowly collecting trades near these breakers and pools.

Putting together these ICT ideas needs a pro-level understanding of how markets are set up and predicting price shifts. Doing so can boost your wins and trading smarts.

ICT FOREX TRADING BREAKER

The ICT FOREX TRADING BREAKER is a tool for traders. It gives them signals for when to enter and exit trades. It uses breakers and liquidity pools to help traders feel more confident. This way, they can spot profitable chances in the market.

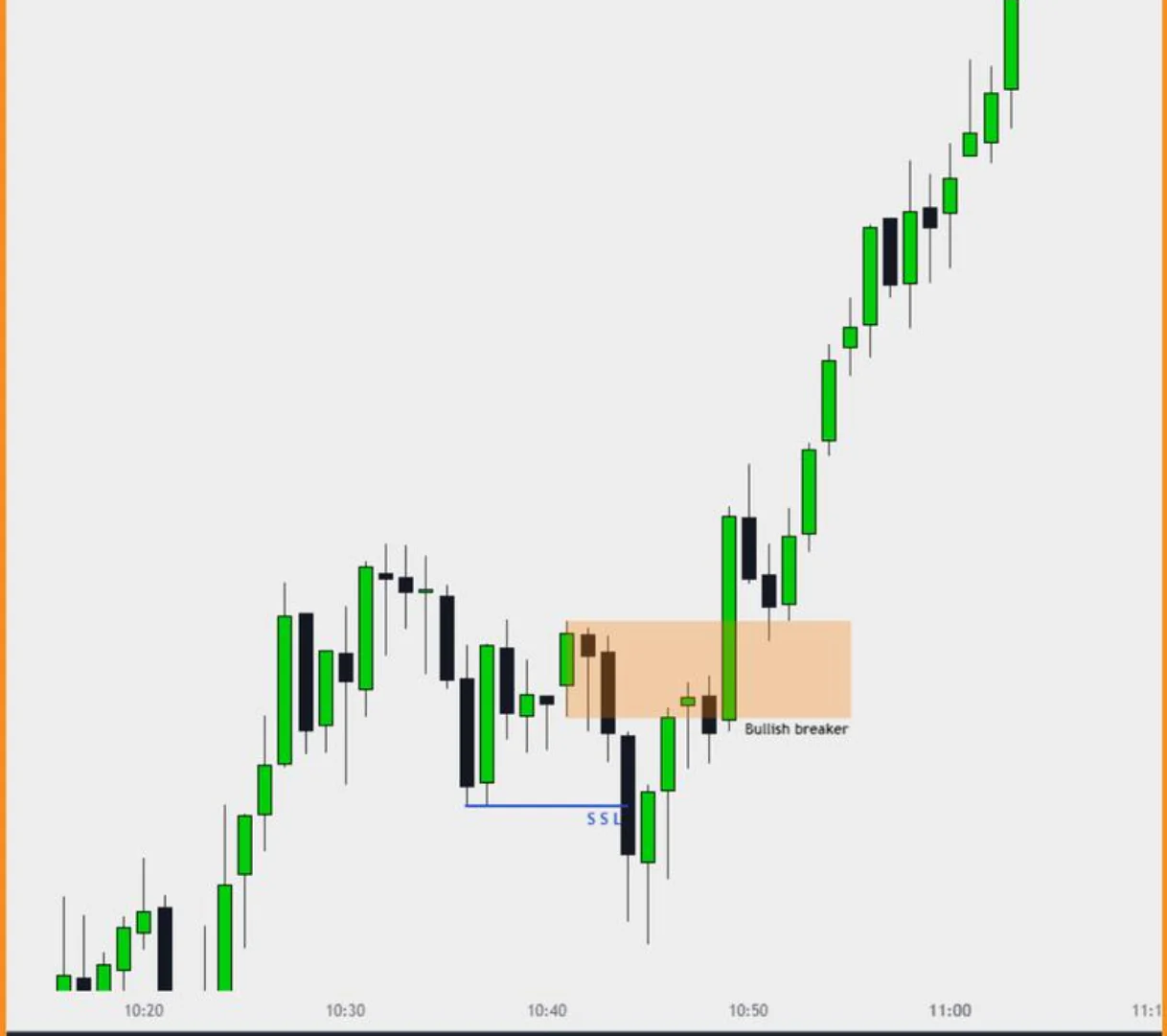

One strategy it uses is called the breaker-block strategy. It’s for looking at different assets like forex, crypto, or stocks. A breaker block is an order block that wasn’t completed due to a sudden change in the market. These come from blocks that signal either the market going up or down.

There are two main types of breaker blocks. One is for when the market looks like it will go up. The other is for when it seems like it’ll go down. To know if a ‘bullish’ or ‘bearish’ breaker block is real, certain things need to happen. For a bullish one, the price must close higher than a previous, lower, point. For a bearish one, the price has to close lower than a previous, higher, point.

When the market is going up, people might pick a bullish breaker block. When it’s going down, they might use a bearish one. It’s also a good idea to put a stop loss about 10 to 20 pips away from the block to stay safe.

The breaker block strategy is all about finding big changes in the market. These changes can show which way the market might move next. Once you spot a breaker block, it can help you guess where the market is going. It’s like finding a new checkpoint on the road. This can guide your choices about when to buy or sell.

To use this strategy well, understanding why prices and market directions change is key. Breaker blocks are found after big price moves stop working out. This can be a sign the market is changing direction. But, it’s smart to wait for certain signs before making a move. These can be specific signs in the market.

Risking wisely is important in this method. Setting stop losses based on the market’s behaviour is useful. This strategy can be helpful for both new and expert traders. Including it with other trading methods can make it even better.

However, like with any trading method, there are risks. These include making bad trades or not managing risk well.

A bearish ICT mitigation block happens when a strong uptrend ends. It’s marked when the price fails to go higher and then drops. After this fall, the market shows signs of staying low. A bullish ICT mitigation block marks the end of a downtrend. The price fails to fall more, then rises, showing a possible upward trend.

ICT Breaker Block is unique. It appears after a big change and a confirmation shift, unlike the ICT Mitigation Block. The ICT Mitigation Block notes a change in price trend, while the ICT Breaker Block highlights the latest key price. For example, on the XAU/USD H4 chart, a bearish ICT block shows a good selling opportunity. This happened when the price didn’t go higher, dropped instead, and the market structure turned bearish.

The Precision of Trading

Trading precision is more than just picking the right entry and exit points. It’s about grasping market dynamics too.

Understanding standard deviations is key here. It helps in spotting potential breakers. This gives traders useful ranges for their buying and selling actions.

Standard Deviations and Breakers

Using standard deviations, traders can spot where the market might hit a pause due to specific prices. These deviations show us areas in which movements are likely to slow down or change direction.

This allows for more precise decision-making.

Fib Retracement Settings

Mixing standard deviations with Fibonacci levels adds a layer of accuracy. With this combo, traders can find important price levels. These are points where the market often reacts significantly

By using these tools together, a trader gets a deeper insight into market behaviour. This approach helps in spotting chances for profit.

The Role of Time in Trading

Time is key in trading, not just daily but weekly too. Knowing these time patterns helps us choose better. For example, we can use the fact that markets often change prices around certain times to our benefit.

Markets act differently each day of the week, and knowing this boosts our trading plans. Understanding when prices may shift towards certain points helps predict market moves. This insight lets us seize better chances.

Adding timing knowledge to our strategies, with a focus on liquidity pools and breakers, makes us smarter traders. With this full view, we pick better times to enter and leave trades. This can lead to better trading outcomes.

The Art of Accumulation

Accumulation means slowly building a trade. This helps avoid big price changes. We aim to make the most of market shifts. In ICT FOREX TRADING BREAKER, we use this method near a breaker. We guess the market will head to a liquidity pool.To do this well, you need to know how the market works and predict its moves

Building Positions with Breakers

In ICT Forex, we enter trades based on AMD principles. Knowing about breakers lets us find important price points. The market follows and reacts at these levels. We then slowly build our trade, foreseeing the market’s path to a big liquidity pool. This blend of breaker and liquidity pool knowledge helps us hugely. It makes us better at predicting and moving with the market.

Understanding market structure, order flow, and concepts like breakers and pools is key for accumulation. With these tools, our trading gets sharper. We set ourselves up for ongoing success in forex.

Identifying Market Structure Shifts

Traders who use the ICT FOREX TRADING BREAKER need to spot market structure shifts. These shifts help ICT traders anticipate asset movements such as forex, stocks, and more. Market Structure Shifts (MSS) are key in the ICT trading method, focusing on analyzing charts and understanding smart money moves.

Bullish Market Structure Shift

Bullish Market Structure Shift happens when a market goes from being bearish to bullish. It does this by breaking lower swing highs with a displacement move. Uptrends show an MSS when prices fall under the recent low but don’t hit a new high. This suggests a possible bearish turn. For a Bullish Shift trade, use Fibonacci from low to high of the displacement. Then, mark the 50% retracement level. But when the market tests these levels again.

Bearish Market Structure Shift

A Bearish Market Structure Shift means the market goes from being bullish to bearish. This happens by breaking higher swing lows with a move. Downtrends may show a bullish MSS if prices go above the recent high but not below the latest low. When trading a Bearish Shift, use Fibonacci from high to low of the displacement. Mark the 50% retracement level. Sell when the market retests these levels.

And always use a stop loss with the ICT method to safeguard your capital.

Conclusion

Learning the ICT FOREX TRADING BREAKER means knowing a lot about how markets work. You need to understand breakers, liquidity pools, and market changes. Using all this knowledge can change how you trade in forex, making it more profitable.

Trading is a process, not a quick win. It takes time, practice, and a love for learning. With these, the ICT FOREX TRADING BREAKER can improve your trading. Always use a stop loss in your trades to keep your money safe. This is a smart way to use the trading strategy without risking too much.

By getting better at the ICT FOREX TRADING BREAKER, we get closer to our trading goals. Let’s see this challenge as a chance to grow and succeed in the market. It’s a new, exciting step in our trading adventure.

What is the ICT (Inner Circle Trader) FOREX TRADING BREAKER?

What are breakers in the context of the ICT FOREX TRADING BREAKER?

What are the different types of breakers?

What are liquidity pools, and why are they important?

How does the market algorithm interact with liquidity pools?

How can traders leverage the understanding of breakers and liquidity pools?

How can standard deviations be used in the context of the ICT FOREX TRADING BREAKER?

How can Fibonacci retracement levels enhance the precision of trading?

How does the time of day and day of the week affect trading with the ICT FOREX TRADING BREAKER?

What is the accumulation strategy in the context of the ICT FOREX TRADING BREAKER?

How can traders identify market structure shifts when using the ICT FOREX TRADING BREAKER?