Did you know nearly 90% of forex traders fail in their first year? This fact shows how crucial it is to have good strategies and accurate trading signals. The ICT (Inner Circle Trader) strategy is key to success in the forex market. It helps traders understand market dynamics, like breakers and liquidity pools, ensuring they make the right trades.

The ICT strategy focuses on precise entry and exit signals. These signals are very valuable for both new and experienced traders. It also looks at market structure, breaker blocks, and liquidity pools, giving traders a big advantage.

ICT uses standard deviations and Fibonacci levels to find the best times to enter and exit trades. This method helps traders make smart choices instead of guessing. For those wanting to learn more, FX Hunter Wealth provides great insights and practical tips.

Key Takeaways

- Nearly 90% of traders fail within their first year, highlighting the need for effective trading strategies.

- The ICT (Inner Circle Trader) strategy focuses on precise entry and exit signals.

- Understanding market dynamics like breaker blocks and liquidity pools is pivotal for successful trading.

- Using standard deviations and Fibonacci levels enhances the accuracy of forex trading signals.

- ICT is regarded as one of the best forex signal providers, aiding traders at all levels to make informed decisions.

- For more in-depth learning, FX Hunter Wealth offers detailed insights and practical advice on implementing ICT strategies.

Introduction to ICT Strategy in Forex Trading

The ICT strategy, or Inner Circle Trader methodology, is a powerful approach in forex trading. It was developed by Michael Huddleston. He has stolen and renamed many concepts from iconic traders like Elliot, Wyckoff, Gann, and Williams gave them cool names and sold them as repackaged trading courses. He is also falsely claiming that he coded the market algorithm and some other marketing bullshits. While he has never proved that he can trade – never won the Robins cup while he was claiming that he will back in 2017. He also lost many trades in his live streams. Anyway, this person deserves respect because he has created a universal language for traders and those who are not so stupid to still follow his every year now mentorship can benefit from his teachings.

This strategy focuses on finding the best times to enter and exit trades. It helps us make the most of market movements. By studying price action, we understand market trends and potential reversals. This gives us the tools to make smart decisions.

Risk management is a key part of the ICT strategy. It offers guidelines to protect our capital and avoid big losses. This is vital for success in forex trading, as managing risks well can greatly improve our performance.

When we use professional forex signals with the ICT strategy, it gets even stronger. These signals provide valuable insights that match the methodology. This helps us make consistent and profitable trades. Using the ICT strategy in our trading helps us achieve success in forex trading.

The Role of FX Hunter Wealth in Forex Trading

FX Hunter Wealth, founded by Dave FX Hunter, has made a big impact on forex trading. It gives traders strong strategies and tools. This helps them understand the complex forex markets and aim for steady profits.

Dave Unlike ICT has prove his live results and its fair to say that he is already the better trader. If not a best trader on the world which he proved many times by winning the various competitions. But he will never admit it as he is still humble.

Dave use methods like COT order flow and smart money technical analysis to make smart choices. He look at CLS ranges and combine them with key levels like order blocks, breaker blocks, and fair value gaps to find the best trading opportunities. These tools are key for those aiming to do well in forex funded trading and pass prop challenges.

Dave FX Hunter stresses the need to know the market’s dynamics and liquidity. Using professional forex signals, traders can get an advantage. This approach helps them succeed and reach their financial targets.

Many traders have passed prop firm challenges thanks to these strategies. They follow strict money management and market reversal tactics. This is very helpful for those in forex funded trading, where being precise and disciplined is crucial.

FX Hunter Wealth does more than just offer trading signals. It offers a complete view of forex trading. It prepares traders to handle the market’s challenges. With ongoing learning and using advanced techniques, traders can keep moving towards financial freedom.

CLS Strategy: A Proven Method for Success

The CLS forex strategy has caught the eye of many traders. It’s known for its skill in understanding order flow and its role in currency movements. This strategy helps us find the best times to enter and leave the forex market. By using the CLS strategy, we can improve our trading, making success more likely.

This strategy relies heavily on analyzing statistical data. This helps us make better decisions, making the CLS strategy a valuable tool for traders.

The CLS strategy also fits well with forex funded trading. It offers a structured way to handle risks and improve consistency. This is key for those aiming to succeed in forex funded trading, like passing FTMO challenges.

Here’s a detailed comparison of the essential components of the CLS forex strategy:

| Component | Summary |

|---|---|

| Order Flow Analysis | Tracks large orders to predict currency movement |

| Timing | Identifies optimal entry and exit points |

| Risk Management | Built-in risk parameters to protect capital |

| Consistency | Emphasis on consistent strategies for long-term success |

By adopting this approach, we can boost our trade results and overall performance. Whether you trade during the day or swing trade, using the CLS strategy with your forex funded trading goals can lead to success.

COT Strategy: Decoding the Commitment of Traders

The Commitment of Traders (COT) report is key for forex traders. It shows us the market’s mood. By looking at this report, we can see what big traders are doing. This helps us guess where prices might go next.

Using the COT strategy gives us clear trading signals. We learn what big players are thinking. For example, if they’re all betting on a currency, it might be a good time to buy.

The COT report also tells us about different trader types.

| Trader Category | Description | Significance |

|---|---|---|

| Commercial Traders | Entities hedging against price fluctuations | Indicator of genuine market trends |

| Non-Commercial Traders | Speculators aiming for short-term gains | Reflect market sentiment and potential volatility |

| Non-Reportable Traders | Small traders with no significant impact | Useful for understanding retail trading tendencies |

In summary, the COT strategy helps us understand the market better. It lets us make smarter trading choices. By reading these signals well, we can lead in the fast-paced world of forex trading.

ICT Strategy Accurate Forex Signals: How It Works

Understanding the ICT strategy is key for successful trading. It’s known for its precision and reliability. This makes it a top choice for traders looking for the best signals.

The ICT strategy uses detailed market analyses and algorithms. It finds profitable trading opportunities with high accuracy.

The ICT strategy’s success comes from its thorough market analysis. It looks at price action, market structure, and liquidity. This approach reduces the noise in forex trading.

This detailed analysis leads to accurate forex signals. These signals open up more trading opportunities and lower risk.

The ICT strategy also fits different trading styles. Whether you trade daily, swing, or long-term, it offers signals that match your goals. This makes it the best signal provider in the market.

Using the ICT strategy also means managing risks well. Tools like stop-loss orders, diversification, and emotional control are key. They help manage risks in forex trading.

By using a well-rounded trading approach, traders can increase profits and reduce losses.

Here is a detailed comparison of the benefits and features of ICT strategy:

| Feature | Benefit |

|---|---|

| Focusing on the CLS ranges | Minimizes Market Noise |

| Waiting for the liquidity purge and confirmations | Higher Profitability |

| Trading Weekly range with H4 confirmations | Allows to watch multiple trading pairs and currencies |

| Incorporation of Risk Management Tools | Deciding the risk per trade before entering the market |

In summary, the ICT strategy offers accurate forex signals and adapts to different trading styles. It also helps manage risks well. By using this strategy, you can gain an edge in the volatile forex market.

Risk Management Techniques in Forex Trading

In forex trading, having a good risk management plan is key to success. By using effective forex risk management strategies, traders can protect their money and find more trading chances.

Timing and price are very important. They help us pick the best times to buy and sell, cutting down on losses. Also, using accurate trading signals and sticking to a plan can boost our success.

Now, let’s look at some basic risk management techniques:

| Technique | Description | Benefit |

|---|---|---|

| Stop-Loss Orders | Automatically closes a position at a predetermined price to limit losses. | Minimizes potential loss and protects capital. |

| Position Sizing | Adjusting the size of each trade based on risk tolerance and account size. | Ensures appropriate risk exposure, preventing over-leveraging. |

| Risk-Reward Ratio | Calculating the potential profit versus potential loss before entering a trade. | Helps in making informed trading decisions with favorable outcomes. |

| Diversification | Focuses on Various currencies | Reduces risk and provides protection against adverse market movements. |

Using these methods, along with learning and practice, follows the ICT mentorship methodology. This way, we not only improve our forex trading success but also grow our profits over time.

Professional forex signals are also very helpful. They give us insights into market trends and the best trading setups. By using them consistently, we can see big improvements in our trading results.

FTMO and Other Prop Firms: Passing the Challenge

Facing the challenges of prop firms like FTMO can feel tough. But, with smart strategies, we can beat these hurdles and get funded. The ICT Strategy uses accurate forex signals to help us navigate the prop firm challenge.

To succeed with FTMO signals, we should use the advice from FX Hunter Wealth. They provide expert guidance and signals to help us meet the challenge. By focusing on professional forex signals, we can plan our trades better and stay disciplined.

It’s important to keep our long-term goals in mind. While passing the prop firm challenge is our immediate goal, we should also think about our bigger ambitions. Using accurate signals and good risk management helps us avoid big losses and increase our profits.

Here’s a comparison of key features from different prop firms, including FTMO. This can help us choose the best platform for our goals.

| Prop Firm | Challenge Complexity | Funding Capital | Challenge Fees |

|---|---|---|---|

| FTMO | 10 % Target / 10% max DD | $25,000 | $277 |

| FTMO | 10 % Target / 10% max DD | $50,000 | $382 |

| FTMO | 10 % Target / 10% max DD | $100,000 | $598 |

Beating a prop firm challenge like FTMO’s takes time and effort. But, with hard work, smart planning, and the right signals, it’s possible. Let’s stay focused and work towards getting a funded trading account.

Maximizing Profits with Swing Trading Signals

Swing trading signals are key for traders wanting to make more money in the forex market. They help us catch big price changes over days or weeks. This way, we can make the most of medium-term trends. It fits well with ICT Strategy, known for finding the best trading times.

Good swing signals let us get into the market at the right time. This boosts our chances of making money. By using these signals and doing deep market analysis, we make better choices. This can also help us get funded by investors and prop firms.

Trading with swing signals helps us make more money and manage market ups and downs better. It keeps us focused on the long game, avoiding short-term market noise. This way, our trades match big market trends, leading to more reliable profits.

| Benefit | Description |

|---|---|

| Accurate Entry Points | Swing signals help in identifying precise market entry and exit points. |

| Medium-term Trends | Allows us to benefit from significant price movements over days or weeks. |

| Increased Profitability | Maximizing profits by capturing major shifts in market trends. |

Learning Opportunities with FX Hunter Wealth

At FX Hunter Wealth, we offer lots of learning chances for traders at every level. If you’re new to forex trading signals or want to get better, we’ve got you covered. Our resources will help you every step of the way.

FX Hunter Wealth is all about learning forex trading. We have video tutorials, webinars, and guides for you. These cover key topics like the ICT Strategy, known for its accurate forex trading signals.

We also offer free forex signals for those starting out. This way, you can practice without risking money. Our aim is to make forex trading easy to understand and accessible to everyone.

Here’s a look at what learning resources we have at FX Hunter Wealth:

| Resource | Description | Benefits |

|---|---|---|

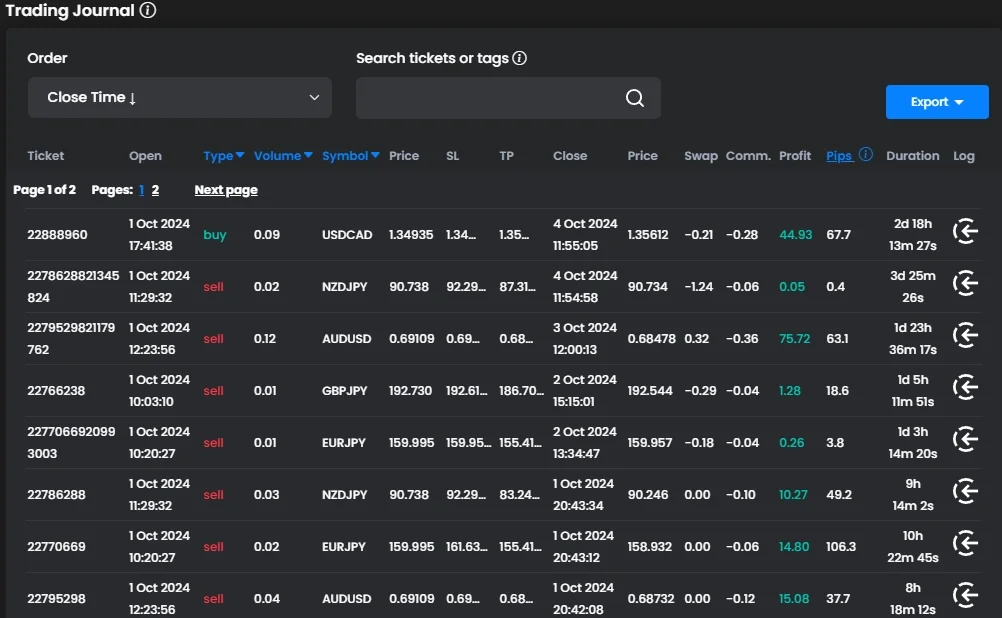

| Weekly Forex Forecast | Weekly analysis and plan for the next week | Easy to follow gives a brief idea what to expect from the next week |

| Tradingview | Daily analysis and updates of the charts | Real-time Time analysis to check the plan and how the play out |

| Telegram | Daily updates about FX Hunterwealth | Detailed explanations, downloadable materials. |

| Free Forex Signals | Signal alerts to guide your trades. | No financial risk, practical experience. |

Our educational materials are made to help you learn smoothly. They’ll prepare you to tackle the forex market and boost your trading skills. By using what FX Hunter Wealth offers, you’ll be ready to succeed in trading.

Conclusion

In wrapping up our look at the ICT Strategy and its role in forex trading success, it’s clear. Accurate forex signals are key for any successful trader. Our dive into FX Hunter Wealth showed how their expertise can boost our trading.

Strategies like CLS and COT highlight the need to understand market dynamics. This knowledge helps us predict the forex market’s ups and downs. By using these strategies, we can keep making profits and growing, which are key for traders.

Risk management and tools from firms like FTMO help us avoid losses and grab opportunities. Whether we’re into swing trading or prop firm challenges, these lessons and tools guide us toward lasting success in forex trading.

FAQ

What is the ICT Strategy in forex trading?

The ICT Strategy, or Inner Circle Trader strategy, focuses on timing, price action, and managing risk. It aims to give traders an edge by offering accurate signals and helping them understand market behaviors.

How does the ICT Strategy ensure accurate forex trading signals?

The ICT Strategy uses proven methods to analyze market dynamics. It looks at smart money concepts, order blocks, and fair value gaps. This leads to precise signals for better trading decisions.

Who is Dave FX Hunter, and what is FX Hunter Wealth?

Dave FX Hunter is the founder of FX Hunter Wealth. He’s an expert in COT order flow and smart money analysis. FX Hunter Wealth offers resources to help traders succeed in forex trading.

What is the CLS Strategy?

The CLS Strategy focuses on how order flow affects currency movement. By studying this flow, traders can find the best times to enter and exit trades. This improves their chances of success.

How does the Commitment of Traders (COT) report aid in forex trading?

The COT report shows the positions of large traders and speculators. By understanding this data, traders can predict price movements. This leads to more accurate signals and better trading results.

What are the benefits of accurate forex signals from the ICT Strategy?

Accurate signals from the ICT Strategy help traders spot high-probability market opportunities. This reduces market noise, improves decision-making, and can increase profitability.

Why is risk management important in forex trading?

Risk management protects a trader’s capital from big losses. Strategies like stop-loss orders, managing leverage, and diversifying trades help traders stay in the market longer. This allows them to pursue profitable trades.

How can I pass prop firm challenges like those set by FTMO?

Using ICT Strategy signals and FX Hunter Wealth guidance, traders can meet prop firm requirements. FX Hunter Wealth’s insights help traders execute effective strategies. This increases their chances of success in these challenges.

What role do swing trading signals play in maximizing forex profits?

Swing trading signals help traders profit from market trends over longer periods. Accurate signals allow traders to enter trades at good times. They can then hold positions through big price movements, maximizing profits while avoiding short-term market noise.

What educational resources are offered by FX Hunter Wealth?

FX Hunter Wealth offers webinars, tutorials, mentoring, and free forex signals. These resources aim to improve both new and experienced traders’ skills. They focus on practical use of trading signals and strategies.