What are high-probability scalps?

Focus:

- Highlighted opportunities in scalping the forex

- Learn directional bias for HTF institutional sponsorship

- Determine the highest probable times of the day

- Framing high probability setups for runs on liquidity

- 10 – 30 pip swings

- There will be times scalping setups will overlap with long-term conditions

- Running out the previous day’s highs/lows

- Targetting buy stops above the previous day’s high or 1 / 2 days ago

- Always going to be looking previous 3 days as your range (counting the current day as day 1)

- The reason for 3 days is because every swing high/low consists of 3 individual bars

USDCAD – Example

H1 CHART

- Highlighted individual daily highs + lows

- Use Daily TF to determine bias

- Use H1 TF to look for draws on liquidity

- If we are bullish – seek to run previous day(s) highs / old highs (vice versa for bearishness)

- Known as draw on liquidity (DOL)

- Going to be in the form of buy-side liquidity or buy stops

- The market will be drawn to that level and dip into the liquidity pool

- Any of the 3 candles for swing points can be up or down close

- The formation is most important – only 3 candles are needed to form this pattern

- Daily swing low should have the middle candle being the lowest low and higher lows to the left and right

- Daily swing high should have the middle candle being the highest high and lower highs to the left and right

Bullish scenario

- Only interested in looking for a daily swing low after a daily swing high has been broken

- Once the highest high of the daily swing high is traded through – this indicates bullish momentum

- Wait for a pullback and swing low to form to show oversold conditions

- After a swing low forms we wait for the last swing candle of the 3 to be violated to the upside ⇒ We play the pullback and target the previous day(s) highs

Bearish scenario

- Only interested in looking for a daily swing high after a daily swing low has been broken

- Once the lowest low of the daily swing low is traded through – this indicates bearish momentum

- Wait for a swing high to form to show overbought conditions

- After a swing high forms we wait for the last swing candle of the 3 to be violated to the downside ⇒ We play the pullback and target the previous day(s) lows

EXAMPLE – BULLISH SCENARIO

DAILY CHART

H1 CHART (HIGHLIGHTED PURPLE ON DAILY CHART)

- Red line = London KZ

- Blue line = New York KZ

- As we are bullish, we expect the previous day’s high to go (denoted by the line)

- We use our fib tool to draw from the lowest body of the previous day’s range to the highest point before a retracement

- Expecting a retracement the next day into OTE

- After retracement, we can look to target the previous day’s high or our current day’s higher high – both are valid buy-side liquidity

EXAMPLE 2

Note that the entry was provided outside KZ, this makes it a low probability

Implementing daily bias

Referring to daily chart

Bullish scenario

- Wait for a swing high on the daily to be broken = Bullish stage

- Swing high = Candle with lower highs to both sides

- We anticipate buying opportunities in the future

- When price retraces, look for a swing low to form but does not break a recent swing low

- Swing low = Candle with higher lows to both sides

- When swing low forms – anticipate the 3rd daily candle’s (last candle of the swing low formation) high to be raided or traded through the following day

- The candle that opens after this should preferably open below the 3rd candle’s high

- Look for previous day highs to be raided each day until a swing high on the daily forms or price reaches a key S&R level

Circle is swing low Blue line is 3rd daily candle expected to be raided or traded through

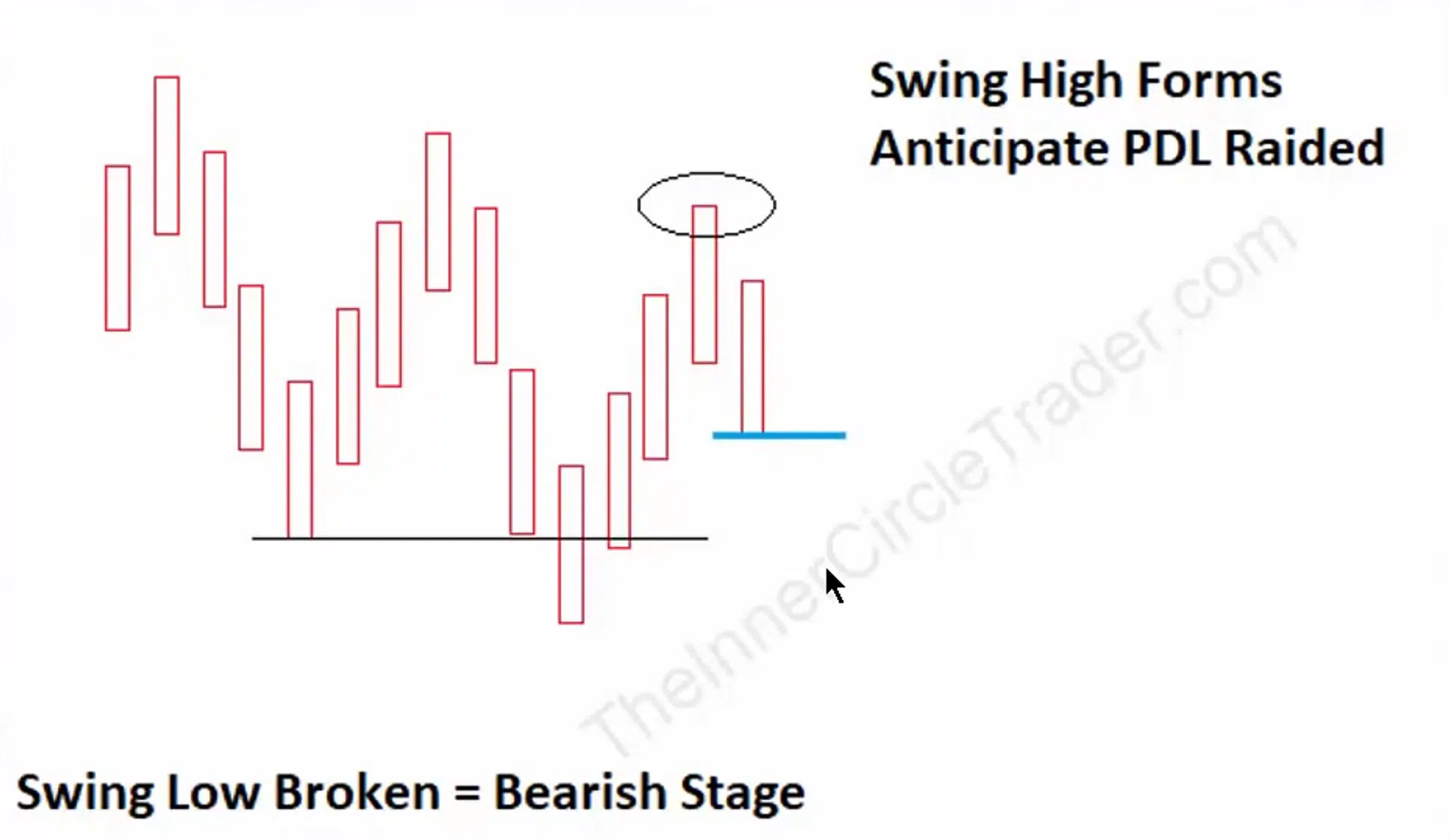

Bearish scenario

- Wait for a swing low on the daily to be broken = Bearish stage

- Swing low = Candle with higher lows to both sides

- We anticipate selling opportunities in the future

- When price retraces, look for a swing high to form but does not break a recent swing high

- Swing high = Candle with lower highs to both sides

- When swing high forms – anticipate the 3rd daily candle’s (last candle of the swing high formation) low to be raided or traded through the following day

- The candle that opens after this should preferably open above the 3rd candle’s low

- Look for previous day lows to be raided each day until a swing low on the daily forms or price reaches a key S&R level

GBPUSD EXAMPLE – BULLISH

DAILY CHART

- After a swing low is created, we wait for the third daily candle’s high to be traded through before we can start looking for longs – in this example, we can be a buyer where the mouse is and target PDH

*Note: this is my personal notes from the ICT’s video. I have screenshotted and noted what is important for my studies I recommend watching the videos by yourself.

M15 CHART

- The left side to the middle vertical line is the previous day, and the right side is the day where we can look for longs

- The green horizontal line is PDH

- We use session highs and lows of the previous day to find our optimal trade entries (as mentioned in Vol 1)

- We are only interested in trading when the price reaches the optimal entry

ICT power of 3 concepts

When the daily bias is bullish:

- 3 components that make up generic price action

- Accumulation phase – longs or shorts accumulated

- Manipulation phase – price goes opposite direction to what the intended future direction will be

- Range expansion / Distribution

- Confirm London session was bullish

- The measure of bullishness after an attempt to go lower was rejected and the price has seen a rally + Daily bias bullish

- Wait for 7 AM NY time to stalk for long

- Between 7 AM – 9 AM NY time, setup will typically form

- After 7 AM NY time, wait for price retracement lower

- NY session will typically retrace from a swing high intraday that was formed for a daily high or a short-term high during the London session

- Ideally, select retracements of at least 20 pips lower

- If no retracement of 20 pips form by 9 AM – don’t take anything

- If it does form – enter 62% fib as it drops

- Expect the price to retest the high of the day or the previous day’s high ⇒ Look for targets 1 & 2 on the fib

When the daily bias is bearish:

- 3 components make up generic price action

- Accumulation phase – longs or shorts accumulated

- Manipulation phase – price goes opposite direction to what the intended future direction will be

- Range expansion / Distribution

- Confirm the London session was bearish

- Want to see the price move above the opening price at midnight NY time then reject and go lower ⇒ Should anticipate the idea of the NY session continuing in bearish conditions

- Wait for 7 AM NY time to stalk for shorts

- Between 7 AM – 9 AM NY time, setup will typically form

- After 7 AM NY time, wait for price retracement

- NY session will typically retrace from a swing low intraday that was formed for a daily low or a short-term low during the London session

- Ideally, select retracements of at least 20 pips higher

- If no retracement of 20 pips form by 9 AM – don’t take anything

- If it does form – enter 62% fib as it rallies

- Expect the price to retest low of the day or the previous day’s low ⇒ Look for targets 1 & 2 on the fib

EXAMPLE

- The vertical line denotes 7 AM NY time

When to expect reversals

- When the H1 chart trades to an obvious old high or old low that has shown a clear willingness to reverse price before – this will likely repeat

- Sometimes the price will not respect an old high or low and those generic S&R levels will give way and we never know for sure

- Far better to expect them to cause a reaction than not to ⇒ Plenty of moves and price swings between these key HTF price points to never have to worry about them

Money management

- Important to implement strict risk controls

- Consider using 0,5% per setup and gradually working your way up to 2% if it meets your “risk tolerance”

- Important not to try to swing home runs or take larger risks. One trade will not make you rich.

- Over-leverage will impede your development and drastically decrease your chances of seeing responsible equity growth

- Rather focus on consistent build-up of your account

*Note: this is my personal notes from the ICT’s video. I have screenshotted and noted what is important for my studies I recommend watching the videos by yourself.